The consolidation of American agriculture and its beef industry continues. USDA’s 2022 Census of Agriculture found 1.9 million farms in the United States, down 7% from 2017 and the smallest number since 1950. Over the last 25 years the number of farms has declined 14%.

“The number of producers [age] 65 and over increased 12%, continuing the trend of an aging producer population,” said a highlight sheet for the census, describing changes since 2017. Nearly four of every 10 farmers were over the age of 65. There was a 9% decline in the number of farmers aged 35-65 years.

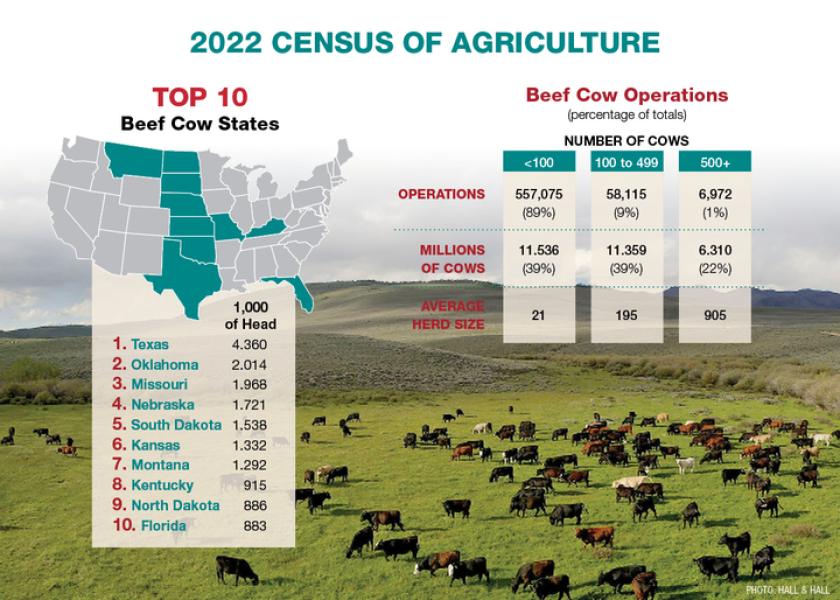

America’s beef industry shows a similar trend to that of agriculture in general. The number of operations with at least one beef cow totaled 622,162, down 106,884 operations (-15%) from the 2017 Census.

The decline in beef operations coincided with a steep decline in America’s beef cow herd. The 2022 Census (not to be confused with the Jan. 1 Inventory report) counted 29.214 million beef cows, down 2.5 million cows (-8%) from 2017’s 31.722 million.

The number of beef cows has declined further since 2022, with USDA’s annual Cattle Inventory showing 28.2 million on farms January 1 of this year. That’s 10% fewer than what USDA’s 2017 Inventory report counted at 31.2 million. America’s widespread drought and some tough economic conditions for cow-calf producers since 2017 is responsible for declining cow numbers.

CONSOLIDATION

Overall, America’s agricultural production is dominated by just 6% of farms with more than $1 million in annual sales. Those 105,384 farms operate 31% of farmland and generate three fourths of sales.

As with the declining number of farmers, the number of acres in farms is also declining at a rapid rate. The 2022 census found 880 million acres in production, down nearly 75 million acres (-8%) from 25 years prior.

Touting the Biden Administration’s efforts to help create “competitive models for small- and mid-sized farms,” Agriculture Secretary Tom Vilsack called the 2022 Ag Census report “a wake-up call to everyone who plays a role in agriculture policy or who shares an interest in preserving a thriving rural America.”

Nowhere are the effects of consolidation more prevalent than the beef industry. Seventy-nine percent of producers own fewer than 50 beef cows and represent just 25% of the herd. Include all producers with fewer than 100 cows and the results are stunning – 89.5% of beef cow owners represent just 39.5% of the nation’s herd, with an average herd size of 20 cows.

That means 60.5% of America’s beef cows are in herds of 100 head or more (58,115 ranches), average size 195 cows. And the 6,972 ranches with 500 or more have 6.3 million cows, 22% of the total, and an average herd size of 905.

The average herd size of all beef cow operations was 47 head based on 2022 census data, up from 43.5 head average in 2017. The census breaks the number of producers into six groups according to size that have fewer than 500 cows. All six of those groups saw decline in the number of operations.

The opposite trend was true in the three groups with more than 500 cows. At 5,408, the census found 870 more operations reporting 500-999 cows (+16%) than in 2017. The 1,000-2,499-cow category found 1,358 ranches, an increase of 156 operations (+11%). Ranches with 2,500 or more cows, the largest category reported, saw a 4% increase from 198 ranches in 2017 to 206 operations in 2022.

The two largest categories, 1,000-2,499 and 2,500 or more, added 275,912 cows to their herds since 2017, a 10% increase.

SOURCE: DROVERS, By Greg Henderson May 31, 2024