Nevil Speer | Nov 21, 2019 BEEF MAGAZINE

There’s a lot of chatter recently about increased cow slaughter, and that’s true, but year over year, we are almost exactly on pace.

The fall run always brings heightened focus on the calf market. But equally important is what’s happening on the cow side; it’s an opportune time to look at cow slaughter and subsequent implications relative to next year’s starting inventory. That is, cow slaughter trends are indicative of producer sentiment.

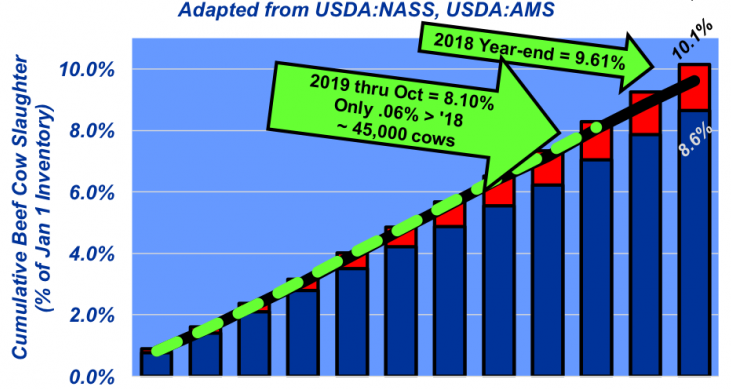

This week’s graph highlights cumulative beef cow slaughter during the past 30 years. The data are represented as percentage of the January 1 inventory – that measure reflects a better perspective of what’s really happening in the industry versus just looking at total number of head.

The trends are separated by years in which liquidation occurred versus those when producers were expanding the cowherd. Meanwhile, last year’s pace is also depicted to provide the 2019 year-over-year comparison.

While beef cow slaughter has jumped in recent weeks, this year’s pace is almost exactly on pace with last year. Through October, beef cow liquidation exceeds 2018 by only 45,00 head (0.06%); total slaughter equals 8.1% and on track to finish on par with the 9.6% rate established last year.

That pace is somewhat tilted toward the annual pace of liquidation years (10.1%). However, even with that, the 2018 pace (9.6%) still facilitated expansion. The beef cow herd grew by roughly 300,000 head in 2018 – the 2019 starting inventory increased to 31.765 million head.

It’s also important to note here that beef producers have facilitated five straight years of growth – the number of beef cows has increased 2.8 million head since 2014. Perhaps, after that extended run, some move toward liquidation might be in the cards?

Beef cow slaughter needs to be closely monitored in coming weeks – it will tell the tale of which way the pendulum swings and dictate the industry’s ultimate inventory on Jan 1, 2020.

Speer serves as an industry consultant and is based in Bowling Green, Ky. Contact him at nevil.speer@turkeytrack.biz